Market Psychology And Its Impact On Solana (SOL) Prices

Wild West cryptographic currency: How market psychology affects the price of Solne (Sun)

In the world of cryptographic currency, market psychology plays a key role in determining the price movement. Although technical analysis and fundamental analysis are essential tools for merchants, understanding how market psychology affects cryptocurrency prices: the truck can help investors make informed decisions. In this article, we will be implemented in the concept of market psychology and its impact on salt prices (Sun).

What is market psychology?

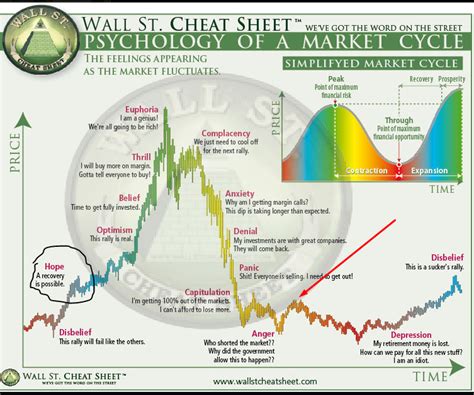

Market psychology refers to the study of how emotions, attitudes and investor behavior affect their decisions, the processes carried out when it comes to buying or selling certain assets, in this case a cryptographic currency. It is a complex interconnection of cognitive bias, cultural influences and psychological factors that form the behavior of investors.

Cryptocurrency Trade Psychology

Cryptocurrencies are often associated with high levels of divination and insecurity. This has led to the development of different market psychology models, including the “Freakonomics” of the thoughts school that explores how cognitive bias makes decisions about investment. Some usual psychological factors that affect cryptocurrency trade include:

- FEEMBRA AND GRUDE : Investors are more likely to buy when they feel terribly or more uncertain, but more willing to sell when they are safe.

- Risk aversion : The cryptocurrency market is often characterized by high levels of risk, which can lead to the priority of safety over potential gains.

- Confirmation bias : Investors tend to seek information that confirms their existing points of view and the negligible contradictory evidence.

- Social test

: It is more likely that people monitor the crowd when they see that others buy or sell certain properties.

Solana (salt) Market Psychology

As one of the main platforms for intelligent contracts, Solana (Salt) is no exception to market psychology. The price of salt has experienced significant volatility lately, and prices have oscillated among ups and downs. To understand how market psychology affects salt prices, let’s examine some key psychological factors that contribute to these price movements.

- Volatility : Market participants are often guided by emotions associated with potential losses or profits. This can be manifested as a desire to sell when the price is high and buy when it is low.

- Risk behavior : salt investors (salt) tend to be risky, which can make their own salt shares sell if they think the market is becoming too volatile.

- IMPACT OF SOCIAL NETWORKS : Social networks platforms such as Twitter and Reddit often trigger market feelings, and users share opinions and information that can significantly affect salt prices.

Case study: impact of market psychology on the price of Solana (Sol)

To illustrate how market psychology affects salt prices, let’s examine several key events:

- 2020: Pandemic COVID-19 : During pandemic, investors became more cautious when investing in crypto currency due to concern for safety and regulatory insecurity. As a result, salt prices have fallen, reaching up to $ 12.

- 2021: Fomo (fear of disappearance) : As winter cryptomas approached in 2021, investors began to look for properties of Safe have as sun, which is considered an alternative to other currency crypts. This led to the increase in salt demand and a subsequent increase in prices.

Conclusion

Market psychology plays an important role in determining the movement of the cost of the cryptocurrency market, including salt (salt). Understanding these psychological factors can help investors make informed decisions when tradeing this property. Recognizing how emotions and behavior handle the market, merchants can develop strategies that relieve possible losses and opportunities for use.