Layer 1 Vs. Layer 2 Solutions: Which Is Better For Scalability?

cryptocurrency: layer 1 vs. layer 2: What is the best for scalability?

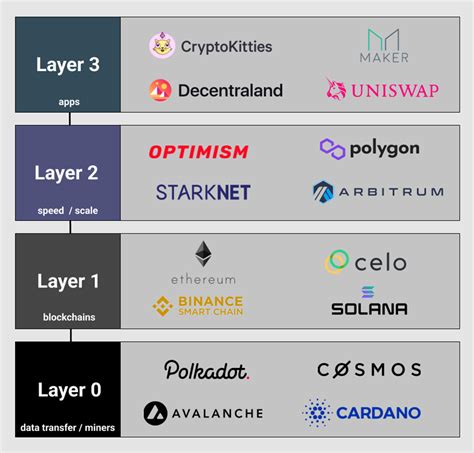

The world of cryptocurrencies develops quickly and new solutions appear every month to solve scalability problems and improve the general impression of the user. Two of the most visible approaches are layer 1 (blockchain) and layer 2 (sidechain). But which of them is best suited to scalability?

In this article, we immerse ourselves in the differences between these two approaches, examining their basic technologies, their use cases and the implications for scalability.

Layer 1: Blockchain solutions

Blockchain technology is a fundamental layer of most cryptocurrencies, including Bitcoin and Ethereum. It is a decentralized distributed book that records transactions in the computer network. Blockchain uses a consensus algorithm to check the transactions, ensuring that all the nodes of the network will agree on the state of the book.

The restrictions on the scalability of blockchain solutions are well known. Here are some key challenges:

* Transaction costs : When more users join the network, transaction costs can increase rapidly, which hinders the treatment of smaller transactions.

* The limits of the block size : the block size limit imposed by most blockchain (for example 1 MB Bitcoin) limits the number of transactions which can be treated in block. This leads to higher congestion and transaction moments.

* Energy consumption : The energy required to extract cryptocurrencies (or verification of transactions on blockchain) contributes to a large trace of carbon and evolution problems.

To solve these problems, developers examine various solutions:

* Sharding : The division of the smaller parallel branches (shards) can increase the capacity of the transaction.

* Scale outside the chain

: the use of alternative networks or platforms for transactions outside the chain can reduce embolism on the main blockchain.

* Sidechains : The creation of separate blocks for specific assets or use cases can help to mitigate certain scope of scalability.

layer 2: Sidechain solutions

Sidechains are smaller parallel blocks that work next to a larger block chain. They are designed to allow faster transaction times and lower costs without prejudice to security or decentralization. The advantages of Siachen include:

* Faster transaction time : failures can treat transactions much faster than basic blockchain.

* Lower costs : The transaction costs on the heights are often much lower compared to their counterparts on the main blockchain.

However, restrictions on Side-Eclace technology occur to consider scalability:

* Reduced security : The ladder is generally not as safe as the main blockchain, which requires more complex cryptographic techniques to maintain decentralization and safety.

* Increase in centralization : failures often rest on a control point (“Piast” or “router”), increasing the risk of centralization and reduced decentralization.

Comparison: layer 1 vs. 2 layer solutions

To determine which approach is the best for scalability, let’s compare the main characteristics of the two:

|

Characteristics

|

Blockchain |

Sidechain |

| — | — | — |

|

Evolution | Limited transaction capacity High transaction capacity

|

Transaction costs | Variable (depending on the size of the block) lower transaction costs

|

Energy consumption | Higher energy consumption lower energy consumption

|

Safety | Required more self -confident cryptographic techniques due to the risk of centralization

Application

To summarize, while layers 1 and layers 2 have their strengths and weaknesses with regard to scalability, blockchain solutions are generally not suitable for large -scale applications.